Block

Unwanted

Subscriptions

Ever jumped through hoops to cancel a subscription? With a Privacy Card, you don’t have to ask for permission: close the virtual card, stop the payments, and cancel the subscription.

Privacy Cards also let you assign spending limits to prevent overcharging and hidden fees—perfect for managing recurring expenses. If a transaction exceeds the limit, we’ll automatically decline it.

Protect

Your

Payment

Information

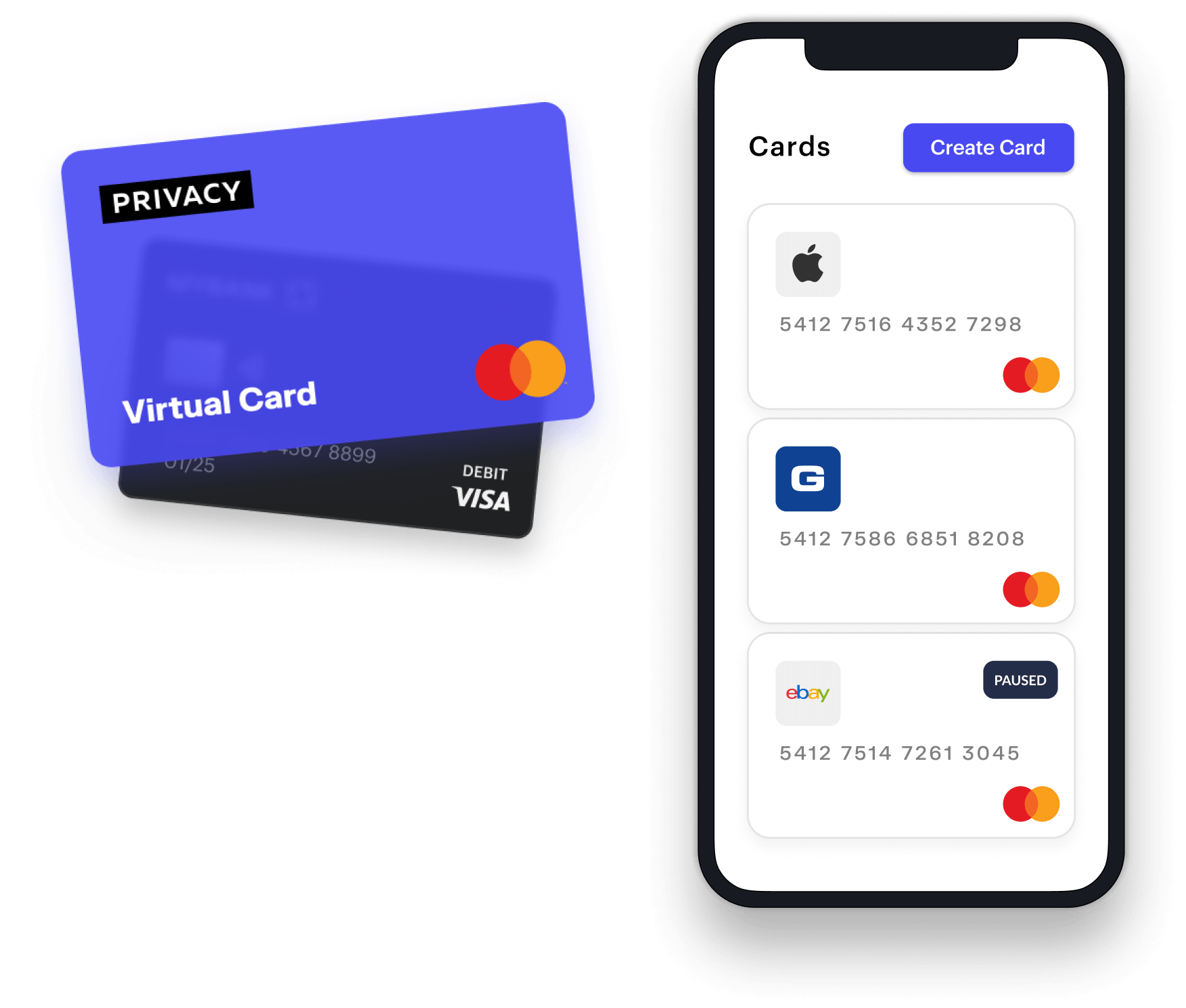

Stop exposing your debit and credit card numbers. Privacy Cards shield your real card info and allow you to pay with an automatically generated, unique 16-digit virtual card number.

Each Privacy Card is generated for and locked to a specific merchant so the card can't be used elsewhere if stolen.

Control

Your

Spending

Track your transactions in our dashboard and receive real-time notifications every time a Privacy Card is used so nothing slips past your radar.

See a charge you don't recognize on your virtual card? Reach out to our expert support team and, in the event of a fraudulent charge, we’ll manage the case on your behalf.

Check

Out

Faster

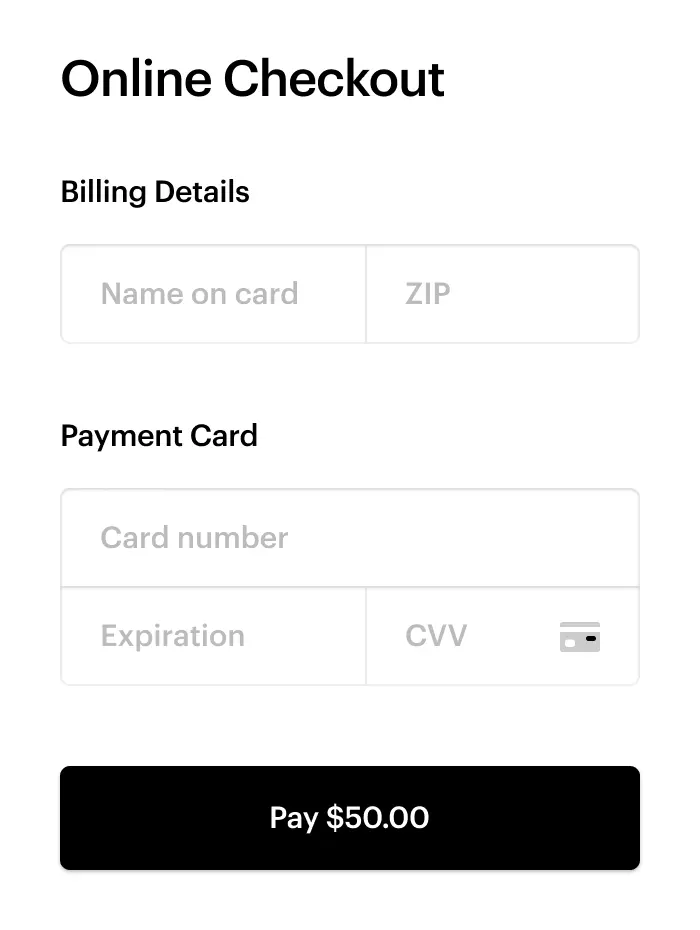

Skip tracking down your purse or wallet and manually typing in card numbers.

Our browser extension will automatically enter a unique virtual card number, CVV, and expiration date for you at checkout in just two clicks.

Why over 250,000 users choose Privacy

FAQs

A virtual card is a unique 16-digit card number with a CVV code and expiration date that can be generated instantly and used to make purchases online or over the phone. Think of it as a normal credit or debit card, but without the physical plastic card.

A Privacy Card is a virtual card that masks your actual payment information. By using a Privacy Card to check out, you can keep your true financial information private from merchants, malicious third parties, and fraudulent actors. Privacy Cards have additional security features that shield you from fraud and unwarranted transactions.

The FTC reported that more than 2.3 million consumers in the U.S. experienced fraud in 2022, equating to nearly $9 billion in losses. Privacy helps you defend against card theft and fraudulent charges.

Privacy Cards automatically “lock” to the first merchant they’re used at and can never be used anywhere else if they’re stolen or compromised in a data breach. Privacy Cards can also be set for one-time use so they automatically close after a single transaction. These built-in protections have helped our users transact with confidence and save money that would have otherwise been lost in a security breach.

Privacy gives you greater control over your spending. You can set customizable spending limits on cards to track and maintain budgets at specific merchants and block hidden fees. If a transaction attempt goes over the limit, we automatically decline it. You can also easily pause, unpause, and close Privacy Cards at any time to manage subscriptions and avoid being overcharged.

Privacy makes it easy to share secure payment information with trusted friends, family members, or employees. With one click, you can share a Privacy Card instead of having to share and expose your real debit or credit card details. Any cards you share will lock to the first merchant they're used with, and you can still adjust spending limits and close the card at your discretion. The card sharing feature is handy for parents setting an allowance card for their kids or small business owners looking to distribute cards to employees.

Some personal information is required for a mandatory bank verification procedure called Know Your Customer (KYC) that must be conducted before our customers can start using our Privacy virtual cards. This verification process is required to comply with anti-money laundering laws and helps protect against fraud.

Privacy, like other card companies, collects transaction fees called interchange from merchants. We don't, and will never, sell our customers' data.

No. Privacy never conducts a credit pull. Using our Privacy Cards will not have any impact on your credit score, and Privacy Cards will not show up on your credit report. You can read more about this here.

The security of our customers’ personal information and data is critical to everything we do. Privacy is PCI-DSS compliant and is held to the same security standards as a bank. For more information, review our security policies.

Privacy is currently available to US citizens or legal residents with a checking account at a US bank or credit union, and who are 18+ years of age.

Get Started in as Little as Three Minutes

Our basic plan is free to use* on domestic transactions because, like other card companies, we collect transaction fees from merchants.

.png)