Credit Karma Virtual Card—Credit Karma’s Instant Access Solution

Until recently, the only way you could access your funds after applying for a new payment card was by waiting for the physical card to arrive in the mail. Realizing how inconvenient that was for the applicant, many card issuers have introduced temporary solutions (such as a temporary ATM card) to allow customers quicker use of their new accounts.

For instance, when you open an online checking or savings account at Credit Karma, you can get instant access to a Credit Karma virtual debit card via a digital wallet while waiting for the plastic debit card to be delivered[1].

This article will explore the Credit Karma virtual card feature and explain:

- What it is

- How to enable it

- How to use it

The information in this article was sourced in September 2023. For updates, visit the official Credit Karma website or contact the company directly.

What Is Credit Karma?

Credit Karma is a personal finance platform that provides its users with various tools to monitor and improve their financial health. Its core services include access to credit scores and reports from TransUnion and Equifax and personalized recommendations for financial products and services[1].

With Credit Karma, users can also:

- Track spending on connected accounts[2]

- File their taxes[3]

- Monitor if their information has been exposed on the dark web[4]

- Open a checking or savings account[5][6]

How Does Credit Karma Work?

Here’s how Credit Karma works:

- After signing up for free with Credit Karma and receiving a credit score and reports, the service will look at users’ credit profiles and find financial products or services—credit cards, loans, or insurance—that the company believes could save them money.

- Credit Karma will share those recommendations with its users.

- If the users apply for them and are approved, Credit Karma might earn a commission[1].

What Types of Cards Does Credit Karma Offer?

Credit Karma users with a checking account—Credit Karma Money™ Spend—can apply for a Credit Karma debit card[7]. As this is the only type of card the platform offers, users can’t get a Credit Karma credit card.

Credit Karma cards aren’t available to users with Credit Karma Money™ Save accounts[7]. Since it’s not a bank and doesn’t provide banking services, the company uses MVB Bank to offer its users bank accounts and the Credit Karma Visa® Debit Card[5].

About the Credit Karma Virtual Card

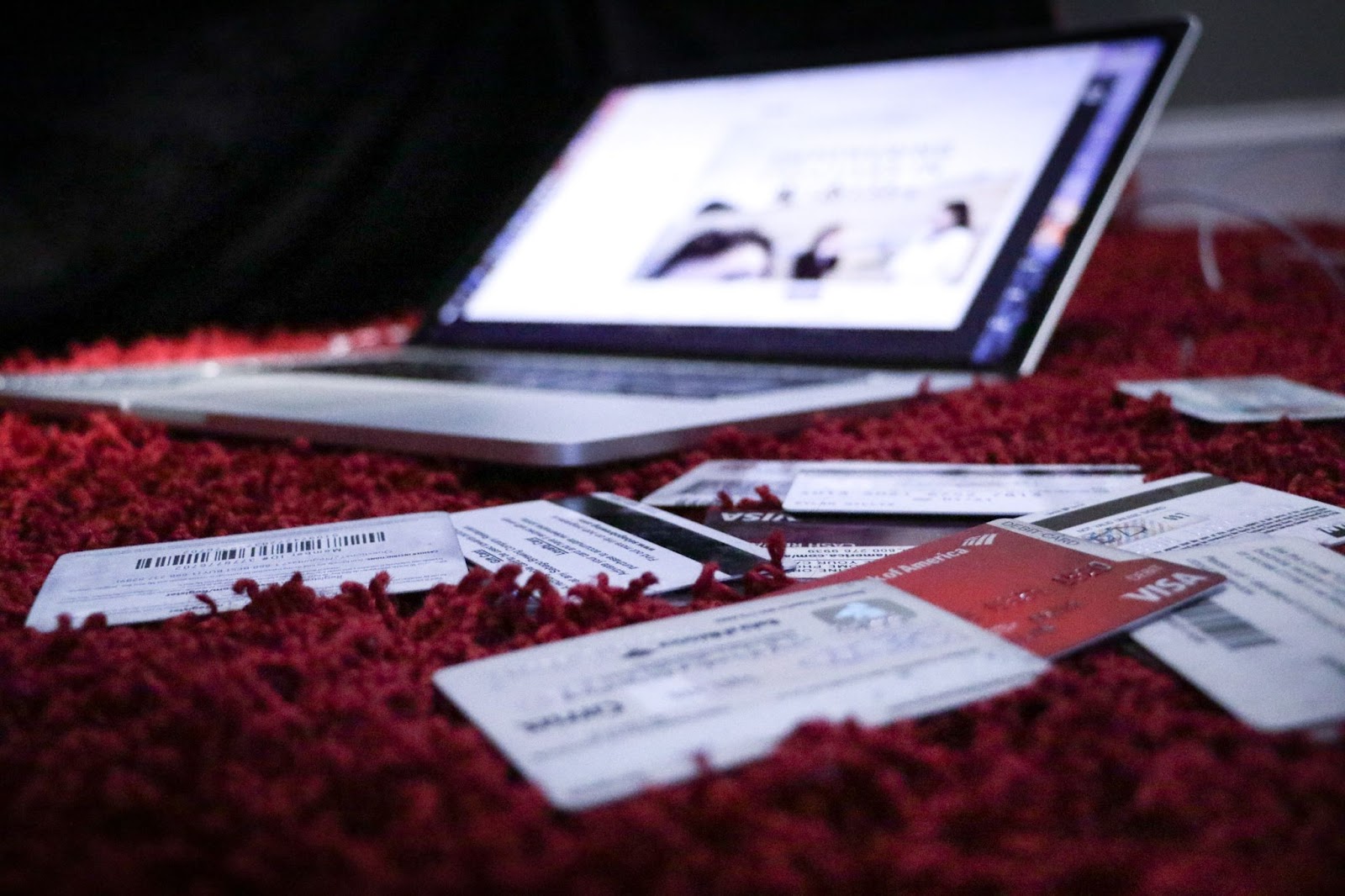

Although the solution from Credit Karma is referred to as a virtual card, it’s important to differentiate it from another similar payment method with the same name.

Virtual cards are generated card numbers that are connected to a real funding source, such as a debit card or bank account, but mask that information during transactions to protect it in case of a data breach on the merchant’s servers. However, the term “virtual card” is often used to refer to any digital payment solution.

What’s sometimes referred to as the Credit Karma virtual card is not a virtual card per se but rather an option to connect the account to a digital wallet. The feature allows Credit Karma customers to access their newly opened account while waiting for the delivery of the physical card, which can take anywhere from 7 to 14 business days[8]. The feature is currently available with the Credit Karma Money™ Spend checking account[9].

Users can access their accounts by setting up a virtual card with a digital wallet[9], which is an app that allows users to securely store their financial information and use it for online or in-store purchases. Besides enhancing security, digital wallets make transactions more convenient, enabling users to pay with their smartphone or smartwatch at checkout terminals. Digital wallets are not accepted everywhere, so the user should check with the merchant to confirm they can pay with their Credit Karma digital card.

How To Get the Credit Karma Virtual Card

After opening an account with Credit Karma, the user needs to fund it before connecting it to a digital wallet[1]. They can do so by[3]:

- Transferring funds from another Credit Karma account or a linked external account

- Depositing a check via the Credit Karma Mobile app

- Making a direct deposit using routing and account numbers

- Making an ACH transfer from an external source

- Depositing cash at a retailer

To access the virtual card feature, the user should[2]:

- Launch the Credit Karma Mobile app

- Go to their account settings

- Navigate to the Debit cards & ATM settings page

- Find the option to connect the account to a digital wallet

At the moment, the available digital wallet options are Google Pay™ and Apple Pay®[2]. The integration process differs slightly depending on the app, so the user should follow the on-screen instructions to complete it. They will likely need to verify their identity via a one-time passcode or another authentication method.

How To Use the Credit Karma Virtual Card

Once the digital wallet has been set up with the Credit Karma account, the user can make purchases online or at a physical location that accepts this type of payment. The following table sums up what the process typically entails:

The Limitations of Digital Wallets

Digital wallets make purchases more convenient and enable users to access their Credit Karma accounts instantly after opening them. Still, this payment method comes with a few disadvantages. For example, despite their increasing popularity, digital wallets are still not as widely accepted as standard payment cards are.

Compared to payments made directly with a credit or debit card, digital wallet transactions are far more secure as the payment information is encrypted and tokenized, which means your actual card or account numbers are not stored withing the digital wallet. However, if the user loses their phone, they could lose access to the digital wallet unless they can reach it from a computer or another source.

Some criminals may also figure out how to use the lost phone to make fraudulent transactions. For this reason, cards loaded onto digital wallets can’t match the security of actual virtual cards, which generate unique and random card numbers for transactions.

While Credit Karma doesn’t offer virtual cards in their true definition, you can alternatively get them from independent virtual card providers like Privacy. Privacy is bank-agnostic and can be linked to most U.S. banks’ checking accounts and debit cards. The provider’s virtual cards are issued by Visa® or Mastercard®, and you can use them at most merchants that accept U.S. debit or credit cards. Privacy Virtual Cards also come with additional features and customization options to give you more control over your spending.

Privacy—Where Security Meets Convenience

Privacy will help you make shopping online a safer and more streamlined experience. The company is Payment Card Industry (PCI) compliant, BBB®-accredited, and maintains the same security standards as any reputable bank. With split-key encryption and password hashing with 100,000 iterations, Privacy increases the safety of your transactions and financial data.

Besides protecting you, Privacy Virtual Cards make checkouts faster. By downloading the Privacy Browser Extension, you can have card details auto-completed into the checkout fields, allowing you to make spontaneous purchases without having to reach for your wallet or memorize card numbers. The extension is available for Chrome, Firefox, Edge, and Safari. The Safari extension also has a mobile version that can be used on iPhones and iPads.

If you want to create and manage cards on the go, get Privacy’s mobile app for Android or iOS. You can also opt to receive a push notification and email each time your virtual card is used or declined.

Privacy Gives You Full Control Over Your Transactions

With Privacy, you get access to numerous features and card settings:

Privacy—Pricing Model

Privacy offers four plans tailored to different user needs, as outlined in the table below.:

Get Privacy Virtual Cards and Elevate Your Online Security

Follow these four simple steps to try Privacy Virtual Cards:

- Create an account

- Provide the information needed to verify your identity

- Connect a funding source (bank account or debit card)

- Request Privacy Virtual Cards

U.S. residents over 18 years old with a checking account at a U.S. bank or credit union are eligible to request Privacy Virtual Cards.

References

[1] Credit Karma. https://www.creditkarma.com/about/howitworks, sourced April 2025

[2] Credit Karma. https://www.creditkarma.com/wealth, sourced April 2025

[3] Credit Karma. https://www.creditkarma.com/tax, sourced April 2025

[4] Credit Karma. https://www.creditkarma.com/id-monitoring, sourced April 2025

[5] Credit Karma. https://www.creditkarma.com/ck-money/checking, sourced April 2025

[6] Credit Karma. https://www.creditkarma.com/ck-money/savings, sourced April 2025

[7] Credit Karma. https://support.creditkarma.com/s/article/Can-I-get-an-ATM-or-debit-card?, sourced April 2025

[8] Credit Karma. https://support.creditkarma.com/s/article/How-do-I-get-my-debit-card, April 2025

[9] Credit Karma. https://support.creditkarma.com/s/article/I-haven-t-received-my-debit-card-yet-where-is-it, sourced April 2025

[10] Credit Karma. https://support.creditkarma.com/s/article/How-do-I-make-a-deposit-into-my-Credit-Karma-Money-Spend-account?categfilter=Checking&childcateg=Credit%20Karma%20Money%20Spend&articledetail=true, sourced April 2025

[11] Google. https://support.google.com/googlepay/answer/7644068?hl=en, sourced April 2025

[12] Apple Pay. https://support.apple.com/en-us/HT201239, sourced April 2025

[13] Google. https://support.google.com/pay/answer/9230808?sjid=9680355166460902812-EU, sourced April 2025

Other Virtual Card Resources To Help Find Your Fit

Here are some guides about how virtual cards work:

Find answers to questions about virtual card offerings from specific banks and financial service providers below: